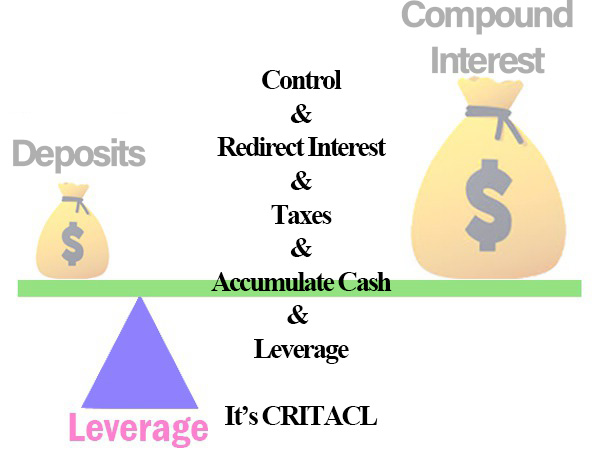

It's CRITACL Knowledge

Taking control of One's income & One's legacy

NO gimmicks.

NO get rich quick.

Knowledgeable and honest sharing for choosing solid income protection decisions with regards to One's income.

CRITACL Blueprint

CRITACL has nothing to do with investing as it relates to financial markets. This has all to do with protecting the income that One earns and what One use to protect the income that One earns.

Protecting One’s income is not depositing it into a bank. Banks use insurance to protect themselves against the loss of the deposits that One deposits with them. The deposits One puts into

banks is insured by the FDIC. The FDIC is backed by the US Government (Translation: Taxpayers). The FDIC insure One’s deposits into a bank up to a set amount. This amount as of

Redirect Interest

On average, One is contributing approximately 34¢ of every dollar of the income One earns to interest. This is income that One can leverage to contribute to One’s own Personal Economy Account (PEA) during One’s lifetime and legacy.

Imagine if the bank gave One back all the interest it earns from One over the life of One’s mortgage?

Imagine if One could earn uninterrupted compounding interest that the bank earns on One’s mortgage payments…and receive the deed to the house that One paid the interest on…and leave a financial legacy benefit to One’s love One’s or to a charity that One has been or would like to continue supporting?

How much would One be willing to pay for such a steal of a deal? One will pay over twice the amount of the original purchase price of One’s home paying for 30 years. This amount is increased further if One refinances which resets the interest payments to zero.

What would happen if One put One’s rent/lease/mortgage payment into an account that earned a rate of uninterrupted compounding interest as One mortgage payment over the same number of years?

Redirect Taxes

On average, One is contributing approximately 42¢ of every dollar of the income One earns to taxes. One can get back all of One’s FICA taxes, State taxes, and sales taxes One pays on all purchases One makes during One’s years of working earning and income and collect uninterrupted compound interest.

Living Expenses

Additionally, on average, One is using approximately 37¢ of every dollar of the income One earns for living expenses. This income can be redirected for use in building One’s Personal Economy Account (PEA) and earning uninterrupted compounding interest from it during One’s years of laboring to earn an income and contribute to One legacy.

Leverage

One can access, up to approximately 92¢ as an employee and up to $1 if self-employed or a business owner of every dollar of the income One earns, the income that One labors to earns and receive uninterrupted compounding interest on the growth.