|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

It's easier to fool One than it is to convince One that One has been fooled. -Mark Twain

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

SUMMARY:

SCHEDULE ONE'S VIDEO CONSULTATION TODAY! of One's portfolio of equity |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

ALERT:

It is likely that One's current equity is "dead equity". One can resuscitate One's equity and give it life. One can generate an additional projected compound annual growth rate of 11.50% on the equity in One's possession. That equates to over an additional $11,000 per $10,000 of equity that One owns. One can do this without tying up One's equity in one place allowing for One's equity to work in two places simultaneously. The milestone marker indicates the point at which One's previous "dead equity" is earning more income than the amount of One's annual deposit allowing One to leverage One's earnings to a greater capacity all without putting One's source of equity at risk. SCHEDULE ONE'S VIDEO CONSULTATION TODAY! |

"Tarot" Income

Which path will One's income take?

(Tarot: "Tarocchi" is believed to be the Italian root of the word "tarot." The exact origin of "tarocchi" is unclear, but it may be derived from the Arabic word "tariqa," meaning "path".)

Current Leverageable Income

Current Leverageable Income

Based on income entered, One has in initial leverageable income and One is in the tax bracket. Leverageable income is income that One can actually control where it goes first. It in raw form is the most valuable purchase that One makes. It is purchased with One time. This is income before the confiscation occurs. If One is a W2 employee, 7.65% of One's income is taken to fund Medicare and Social Security. Not only is it taken first, One can not not pay it later (There is a pun in what it is for.).

Projected Leverageable Income

Projected Leverageable Income

Based on a minimum annual increase of 3% One is projected to be earning in leverageable annual income in years. This will result in One earning over in total projected leverageable earnings between now and years later. One's earnings on One's accumulated income is projected to exceed in years. That is years earlier than the years One entered.

Warehoused Income

Warehoused Income

is the amount of leverageable income ( income less Medicare " Social Security Taxes ) that One is projected to earn during the next years. This is income that One can control and have working for One as it accumulates and into a life-of-leisure.

Projected Earned Interest

Projected Earned Interest

is the amount of interest that One can earn as income and have access to from controlling the income that One earns during the next years. Although One entered a specific numbers of years, the income that One accumulates can continue to increase after that period of time.

Projected Accumulated Income

Projected Accumulated Income

is the amount of income that One can accumulates from the income that One earns and the income that One's income earns for One. This is One's income earned and interest earned combined.

" It's not how much income One earns, but how much income One keep, how One keeps it working for One, and how many generations One keeps it working. "

Projected Earned Income

Projected Earned Income

One is projected to be earning in 40 years. Using the same component as annuities, One is able to leverage One's own accumulated reserves to receive an ever increasing beginning tax-free lifetime guaranteed income of , equivalent of ( of projected income) in taxable income, as well as contribute to and leave a legacy based on One's future projected tax bracket of .

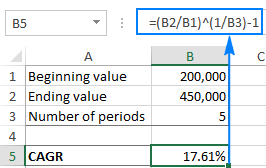

Compound Annual Growth Rate

Compound Annual Growth Rate

Compound Annual Growth Rate (CAGR), , represents the growth rate that One's earned income earns each year during the next years.

(For illustration purpose only. Not representative of values entered.)

Taxes Refunded

Taxes Refunded

One is scheduled to pay . One could recoup over in lost opportunity cost. This is . Not only will One still controls the tax dollars that One paid, One earned and controls the interest One's dollars earned. This is a total of in capital working for One.

Home Purchase "Financing" Options Snapshot

In considering purchasing a home, one of the considerations is the down payment. Many are attempting to save for the down payment in conjunction with other "life expenses" are not aware that there is an alternative in doing so. One can leverage One's regular expenses (income) to earn interest while simultaneously paying One's "life expenses" without the added pressure of "saving" to make a purchase of a house. However, if One does decide to "save", One will accumulate a larger down payment in conjunction with the leveraging process. Hover cards below to reveal the number of years that One can forcast purchasing a house based on the amount that One entered above without "budgeting". What One does is redirect the income that One makes One's payments and purchases with first which allows One to earn interest on One's earned income and then use leverage to pay One's expenses and then make One's payments and pay One's expenses. One can leverage the "Monthly Mortgage Subsidy" to apply towards One's mortgage principal and reduce the payment years of One's payments.

This "redirecting" not only provides One with the ability to leverage the income that One earns to subsidize One's down payment. It continues in increasingly subsidizing One's monthly mortgage payments as well as reducing the number of years that One pays in the process by over half. Reducing a 30 year mortgage to less than 15 with it's own built-in "Payment Assistance Engine (PAE)™" with other unbelieveable benefits.

When doing a comparison of online calculators, One will likely see lower prices with regards to the "Purchase Price" of a home. This is likely due to those calculators not considering the maximum (excluding Medicare and Social Security) amount of the income that One earns. The difference will range between approximately 10% to 39%. One can see results when entering a specific portion of savings that One allocates as the values displayed by default are calculated from the interest earned from One's earned income from One taking control of One's income.

Note: Loan projection numbers are calculated based on a 3% cost-of-living (COLI) increase of One's initial income in the "Year Acheived" and a % mortgage rate with a % debt-to-income ratio (DTI).

3% Down Loan Projection

3% Down Loan Projection

Year Acheived

Estimated Income At Projection

Down Payment Accumulated

Purchase Price

Monthly Payment

Monthly Mortgage Subsidy

3.5% Down Loan Projection

3.5% Down Loan Projection

Year Acheived

Estimated Income At Projection

Down Payment Accumulated

Purchase Price

Monthly Payment

Monthly Mortgage Subsidy

10% Down Loan Projection

10% Down Loan Projection

Year Acheived

Estimated Income At Projection

Down Payment Accumulated

Purchase Price

Monthly Payment

Monthly Mortgage Subsidy

20% Down Loan Projection

20% Down Loan Projection

Year Acheived

Estimated Income At Projection

Down Payment Accumulated

Purchase Price

Monthly Payment

Monthly Mortgage Subsidy

Projected Earned Income: Income earned for a specific year

Accumulated Earned Income: Accumulated income and interest earned combined

CRITACL Cummulative Interest Earned: Accumulated interest earned on income